-

tel:

+86-18961602506 -

email:

fly03@flynewenergy.com

Lithium battery new energy industry chain map and development analysis

Jul 18, 2023

introduction

The lithium battery new energy industry is a whole industry chain around the production of lithium ion batteries. Lithium-ion batteries are a type of rechargeable batteries that rely on lithium ions to move between the positive and negative electrodes to achieve charge and discharge. They have high energy density, many cycles, long service life, fast charging, high-power discharge, and good environmental performance. features. In recent years, lithium-ion batteries have been widely used in new energy vehicles, consumer electronics, energy storage and other fields, with increasingly rich application scenarios and continuous improvement in product quality. Vigorously developing the lithium battery new energy industry is an important measure for the country to realize energy transformation and complete the "double carbon" strategic goal.

01

Industrial chain panorama

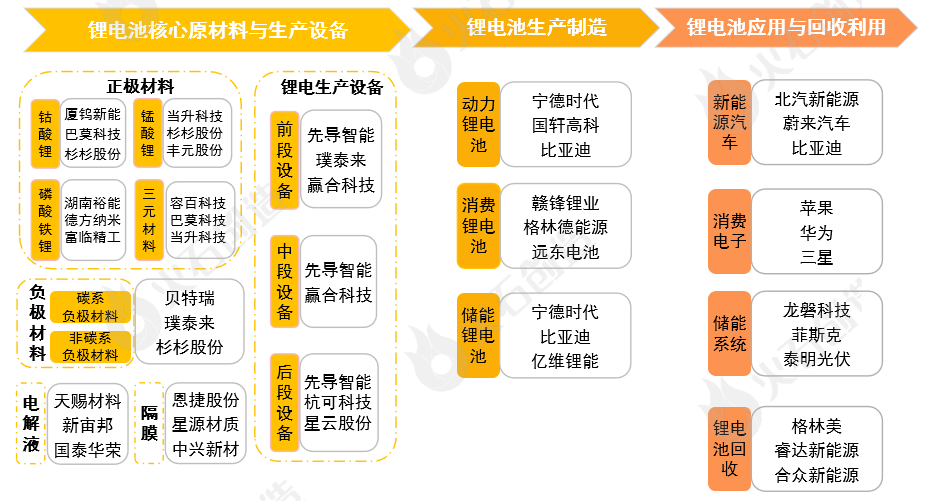

The upstream of the lithium battery new energy industry chain mainly includes key materials such as positive electrode materials, negative electrode materials, electrolytes, and diaphragms, and lithium battery production equipment; the midstream is the production and manufacture of lithium batteries for power, consumption, and energy storage; the downstream is the application and recycling of lithium batteries The application fields include new energy vehicles, consumer electronics, energy storage systems and other industries. At present, the domestic lithium battery industry has formed a complete production chain system from lithium ore mining, lithium battery key material production, lithium battery manufacturing application, recycling and reuse.

02

Industry Development Status

(1) Development history

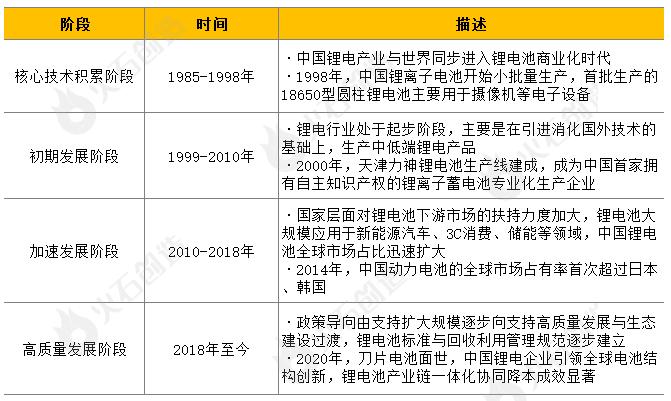

In terms of time, the development of my country's lithium battery new energy industry is mainly divided into four stages: core technology accumulation, initial development, accelerated development, and high-quality development, as follows:

In the future, with the continuous advancement of technology, the development of the lithium battery new energy industry will enter into a policy-led and technological innovation-driven, gradually broaden the market competitiveness of lithium-ion batteries in terms of quality, safety, and environmental protection, and usher in a wider application space and development opportunities.

(2) Industrial scale

1. The production scale of lithium batteries continues to expand

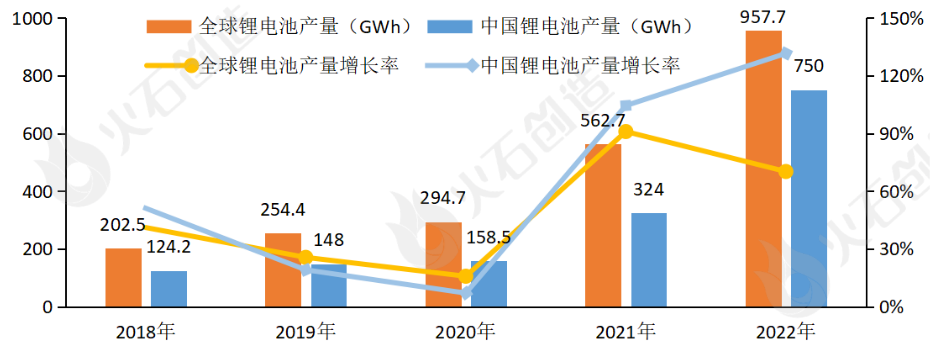

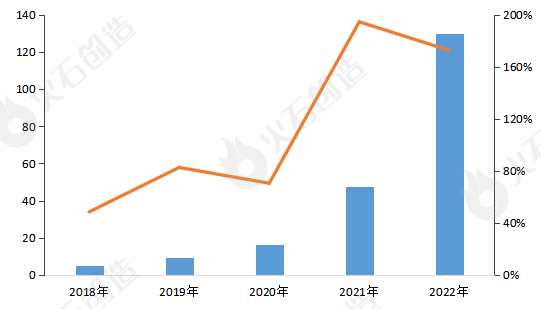

Affected by the growing downstream demand, my country's lithium battery production continues to rise. According to relevant data, my country's lithium-ion battery shipments will reach 750GWh in 2022, a year-on-year increase of more than 130%, exceeding the global average growth rate, accounting for more than 75% of the global lithium-ion battery shipments, and has become the world's largest lithium-ion battery for six consecutive years. First, the total output value of the industry exceeded 1.2 trillion yuan, about twice the total output value of the industry in the previous year. From 2018 to 2022, the compound growth rate of my country's lithium-ion battery industry is as high as 56.76%, which has entered the fast lane of industry development.

Driven by the unexpected growth of the new energy terminal market, the domestic power lithium battery shipments and installed capacity have shown a high growth trend. my country's power lithium battery shipments far exceed the other two types of lithium batteries, with a compound growth rate of 64.85% in the past five years; in 2022, the installed capacity of power lithium batteries will be 260.9GWh, with a compound growth rate of 61.6% in the past four years. As of the end of 2022, China's power lithium battery production capacity accounts for about 80% of the world's total. Among the world's top ten power lithium battery manufacturers, China occupies 6 seats, and CATL ranks first in the world for six consecutive years.

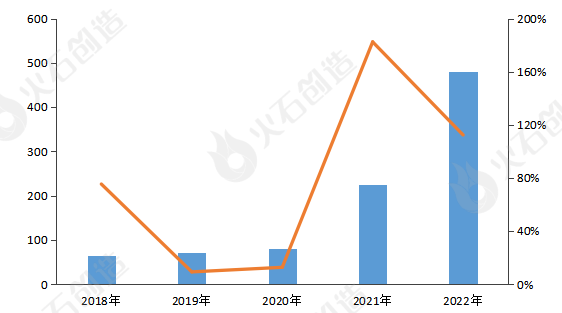

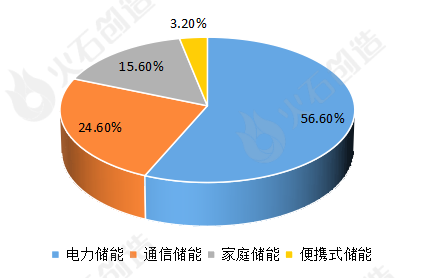

Driven by the "dual carbon" strategy, lithium batteries have accelerated their rise in energy storage fields such as wind and solar energy storage, communication energy storage, and household energy storage, and ushered in a growth window period. In 2022, my country's energy storage lithium battery shipments will exceed 100GWh for the first time, accounting for more than 80% of the global energy storage lithium battery, a year-on-year increase of 171%, and the cumulative installed capacity of energy storage lithium batteries will increase by more than 130%. From the perspective of energy storage lithium battery applications, the application market share of power energy storage accounts for more than 50%, which is the largest application field, followed by communication energy storage, household energy storage, and portable energy storage, which account for about 25%. The proportion of field applications is small.

2. The output of key materials has increased substantially simultaneously

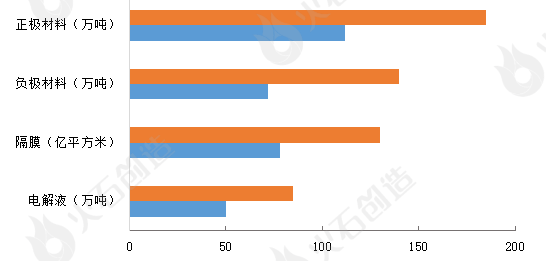

According to data from the Ministry of Industry and Information Technology, in 2022, the output of first-order materials directly used in lithium batteries such as positive electrode materials, negative electrode materials, separators, and electrolytes in my country will be approximately 1.85 million tons, 1.4 million tons, 13 billion square meters, and 850,000 tons, a year-on-year increase. Both reached more than 60%.

(3) Industrial structure

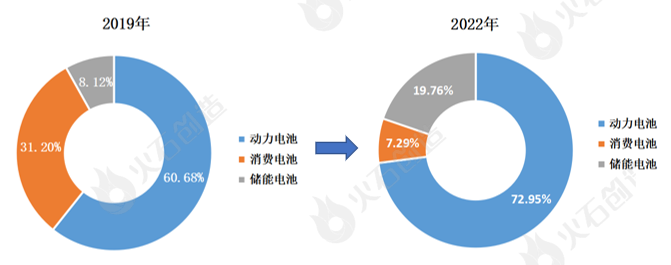

From the perspective of application fields, power batteries still occupy a leading position in the industry, energy storage batteries are showing a rapid development trend, and lithium batteries in the traditional 3C digital field have declined sharply. The data shows that in 2022, my country's power battery shipments will account for more than 75% of the entire lithium battery market share, and the proportion of energy storage lithium batteries will increase from 8.12% in 2019 to 17.33%. It was 48GWh, and its proportion dropped from 31.2% in 2019 to 6.4%.

03

Industry Development Trend

(1) The demand for lithium battery applications will continue to be strong

In order to cope with the global environmental protection and energy crisis, the carbon emission management standards in the global automobile market are becoming stricter, forcing traditional automobiles to accelerate the transformation to new energy vehicles, which will promote the significant growth of the market demand for power batteries. At the same time, affected by the acceleration of energy transformation and power system reform, electrochemical energy storage will play a role in more integrated scenarios, and high-performance energy storage batteries will usher in explosive growth. Therefore, under the dual drive of "power + energy storage", the demand for lithium battery applications will reach a new height.

(2) Lithium battery technology route will be diversified

At present, in the field of power batteries, ternary and lithium iron phosphate are the mainstream technical routes, in the field of energy storage batteries, lithium iron phosphate batteries are the mainstay, and in the field of consumer batteries, lithium cobalt oxide batteries are the mainstay. In the future, in order to meet different needs in different application scenarios, and at the same time due to higher requirements for energy density, safety, and cycle life, the diversified development of lithium battery technology routes will become inevitable. Solid-state batteries, lithium manganese iron phosphate batteries, and lithium-rich batteries The development trend of new lithium battery technology routes such as manganese-based batteries is improving.

(3) Battery recycling will become a new direction of development

Lithium batteries have a high recycling value. Decommissioned batteries in good condition can be used in stages, and scrap batteries in poor condition can be recycled to extract nickel, cobalt, manganese, lithium and other resources. With the continuous growth of lithium battery shipments and usage, the number of decommissioned batteries and the amount of leftover materials will continue to rise. It is estimated that the number of decommissioned power batteries will reach one million every year after 2025. Due to the superimposed influence of tension and other factors, the recycling of lithium batteries will usher in a development trend. At present, many companies at home and abroad are researching and developing battery recycling and recycling technologies, which will play a positive role in the sustainable development of the lithium-ion battery industry.